Rail Vikas Nigam Limited (RVNL) is gaining massive investor attention as its stock continues to rally. With a consistent inflow of orders, strong government backing, and positive financial results, RVNL share price has witnessed a remarkable surge. Let’s dive deep into the factors driving this growth, and explore why RVNL is becoming one of the most watched stocks in the Indian railway sector.

Table of Contents

1. What is Fueling the Rise in RVNL Share Price?

The RVNL share price has jumped significantly in recent months, driven by multiple favorable developments. The rally isn’t just based on speculation — it reflects strong fundamentals, solid earnings, and an expanding project pipeline. Investors are bullish, and for good reason in stock market.

2. Robust Order Book Strengthens Market Confidence

One of the biggest contributors to RVNL’s rise is its expanding order book. The company has been awarded several high-value infrastructure contracts, solidifying its position as a key player in the Indian railway ecosystem.

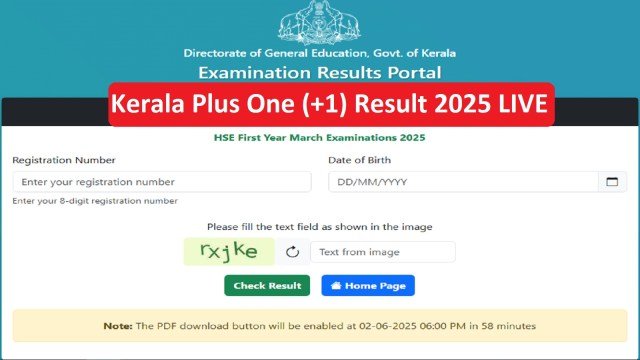

- A ₹1,187 crore project from Kerala State IT Infrastructure

- A ₹458 crore project from North Eastern Electric Power Corporation

These orders not only showcase RVNL’s competence but also hint at a healthy pipeline for the future. A strong order book builds trust among investors, signaling future revenue stability.

3. Q4 FY25 Earnings Reflect Financial Discipline

RVNL’s Q4FY25 results have added fuel to the fire. The company reported consistent growth in revenue and net profits, backed by efficient execution and cost control.

- Strong cash flow generation

- Reduced debt levels

- Steady margins despite inflationary pressures

The company’s performance indicates it’s managing its operations with financial discipline, which bodes well for long-term investors.

4. Technical Breakout Signals Bullish Momentum

From a technical analysis perspective, RVNL has broken out of key resistance zones.

- Previous resistance at ₹190 has been decisively breached.

- The stock recently touched ₹218, signaling a bullish breakout.

- Current resistance lies around ₹225, with strong support near ₹190.

Traders and chartists are closely tracking RVNL for short-term opportunities. Bullish patterns like cup-and-handle and ascending triangle formation suggest further upside potential.

5. Indian Government’s Focus on Infrastructure Development

RVNL operates in a sector that is heavily backed by the Indian government. The government has ramped up its investment in railways, especially in:

- Electrification projects

- New railway lines

- Station redevelopment

- Connectivity to remote areas

With policies aligned to promote public-private partnerships, companies like RVNL are in the sweet spot. The union budget allocations consistently show increased spending on railway modernization.

6. Inclusion in Mid-Cap Portfolios Boosts Liquidity

Institutional investors have also started building positions in RVNL. As a result, RVNL is now a preferred choice in many mid-cap and infrastructure funds.

- Mutual fund houses are increasing exposure.

- Foreign institutional investors (FIIs) have shown renewed interest.

This inclusion improves liquidity, builds credibility, and helps attract long-term capital. It also reduces volatility as the stock gets broad-based ownership.

7. Stock Still Undervalued Compared to Peers

Despite the recent surge, RVNL remains undervalued when compared to its industry peers. Valuation metrics suggest there’s still room for growth:

- Price-to-Earnings (P/E) ratio lower than average

- EV/EBITDA still attractive

- PEG ratio supports growth with value

RVNL combines growth potential with value, making it attractive to both growth investors and value hunters.

8. Short-Term and Long-Term Price Projections

Market analysts have raised their short-term targets to ₹225–₹235, thanks to the strong technical indicators and ongoing news flow.

Long-term projections are even more promising, with expectations touching ₹280–₹300 levels, provided:

- New order inflows continue

- Project execution remains on track

- Macroeconomic conditions stay supportive

With a firm base near ₹190, the downside appears limited unless there is a major market disruption.

9. Risks That Investors Should Monitor

While the outlook is optimistic, every investment comes with risks. For RVNL, key risks include:

- Delay in government funding or approvals

- Execution delays due to regulatory or land acquisition hurdles

- Rising raw material costs that can pressure margins

- Broader market correction or global economic instability

Investors must adopt a balanced view, keeping stop-loss levels in mind and staying updated on the company’s announcements.

10. RVNL’s Role in Transforming Indian Railways

RVNL isn’t just another railway company. It’s one of the main engines behind India’s rail transformation. From electrification to modernization, from last-mile connectivity to high-speed rail segments, RVNL plays a strategic role in infrastructure creation.

Its technical expertise, execution capability, and long-standing relationship with Indian Railways make it a cornerstone player in the sector.

11. Analyst Views and Market Sentiment

Top market analysts from firms like Motilal Oswal, ICICI Direct, and Kotak Securities have given a bullish outlook on RVNL. Reasons cited include:

- Consistent revenue visibility

- Strong sector tailwinds

- Clear government commitment

- Best stocks to buy now

Sentiment remains positive, and retail investors are riding the wave, thanks to stronger media coverage and market buzz.

12. Conclusion: Is RVNL a Smart Buy in 2025?

In a market that often fluctuates based on speculation, RVNL stands out with strong fundamentals, clear growth drivers, and solid execution records. The company is backed by long-term government vision, making it more stable than many peers.

If you’re looking to diversify into infrastructure, especially railway stocks, RVNL offers a compelling investment opportunity long term investments and best stocks to buy now. It may not be without risks, but the potential rewards — both in the short and long term — look promising.

Turn Small Savings into Big Wealth.

Stay informed, track technical levels, and keep an eye on upcoming orders. RVNL may just be the growth story you’re looking for in 2025.